Some deliveries may take a little longer than usual due to regional shipping conditions.

Customer Services

Copyright © 2025 Desertcart Holdings Limited

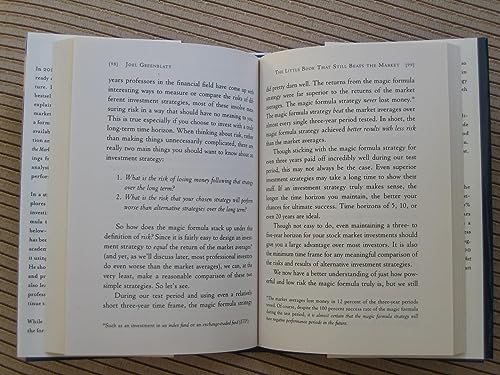

desertcart.co.jp: The Little Book That Still Beats the Market (Little Books. Big Profits) : Greenblatt, Joel, Tobias, Andrew: Foreign Language Books Review: I first read this six years ago and I've re-read it roughly one a year since. In my view this is an investment classic. His target audience is his teenage children, and he's a wickedly funny writer - so the book is an easy read. For a technical book, that's quite an achievement. He starts out by explaining the basics of safe investing - banks accounts and government bonds. Then he moves into riskier investing in businesses via the stock market. He gives a great explanation of how a business works, via the fictional "Jason's Gum Shops" and "Just Broccoli". While doing that, he explains what the key fundamental data means e.g. sales, cost of sales, earnings, income. We're eased into the technicalities by reading the story. Ben Graham's "Mr Market" and "margin of safety" then make an appearance, placing Greenblatt firmly in the value investing camp. But he explains that value investing isn't easy, and you're up against finance professionals. He's come up with a "Magic Formula" for us to use. It's been heavily and successfully back tested. Yet in concept it's very simple: a) Find the earnings yield of companies, and sort them from highest to lowest. Give the best score of 1, the next a score of 2, and so on. This searches for the best bargains. b) Find the return on assets for the same companies, and create a new list sorted by ROA. Again, give them scores, 1 for the best, etc. This searches for great companies. c) Add these two numbers together to get the company's magic formula score. This gives great companies at relatively cheap prices. d) Buy the top 30 companies. This creates a portfolio, to minimise risk. e) Sell them after 12 months, and repeat. I forward tested it back in 2010, reviewing the results a year later. Some companies did badly, some extraordinarily well - as Greenblatt predicted. The key was the portfolio did well. It did slightly better than the S&P 500. I noticed that some of the performance was driven by two or three companies which were taken over. I've repeated the exercise in following years, when it also did well. It's easy to find US companies which fit the bill - he shows you on his website. For UK stocks, you can get them via the "ShareScope" app. If you're into value investing, you should take a look at this book. If you want your children to understand the stock market and invest for their future, you can't go wrong with this. Review: Simple and straight to the point. An essential part of anyone's library, let alone investors...

| Amazon Bestseller | #44,190 in Foreign Language Books ( See Top 100 in Foreign Language Books ) #22 in Commodities Trading #124 in Introduction to Investing #229 in Professional & Technical Finance |

| Customer Reviews | 4.5 4.5 out of 5 stars (4,944) |

| Dimensions | 5.1 x 1.2 x 7.2 inches |

| Hardcover | 208 pages |

| ISBN-10 | 0470624159 |

| ISBN-13 | 978-0470624159 |

| Language | English |

| Publication date | September 7, 2010 |

| Publisher | Wiley; 1st edition (September 7, 2010) |

A**R

I first read this six years ago and I've re-read it roughly one a year since. In my view this is an investment classic. His target audience is his teenage children, and he's a wickedly funny writer - so the book is an easy read. For a technical book, that's quite an achievement. He starts out by explaining the basics of safe investing - banks accounts and government bonds. Then he moves into riskier investing in businesses via the stock market. He gives a great explanation of how a business works, via the fictional "Jason's Gum Shops" and "Just Broccoli". While doing that, he explains what the key fundamental data means e.g. sales, cost of sales, earnings, income. We're eased into the technicalities by reading the story. Ben Graham's "Mr Market" and "margin of safety" then make an appearance, placing Greenblatt firmly in the value investing camp. But he explains that value investing isn't easy, and you're up against finance professionals. He's come up with a "Magic Formula" for us to use. It's been heavily and successfully back tested. Yet in concept it's very simple: a) Find the earnings yield of companies, and sort them from highest to lowest. Give the best score of 1, the next a score of 2, and so on. This searches for the best bargains. b) Find the return on assets for the same companies, and create a new list sorted by ROA. Again, give them scores, 1 for the best, etc. This searches for great companies. c) Add these two numbers together to get the company's magic formula score. This gives great companies at relatively cheap prices. d) Buy the top 30 companies. This creates a portfolio, to minimise risk. e) Sell them after 12 months, and repeat. I forward tested it back in 2010, reviewing the results a year later. Some companies did badly, some extraordinarily well - as Greenblatt predicted. The key was the portfolio did well. It did slightly better than the S&P 500. I noticed that some of the performance was driven by two or three companies which were taken over. I've repeated the exercise in following years, when it also did well. It's easy to find US companies which fit the bill - he shows you on his website. For UK stocks, you can get them via the "ShareScope" app. If you're into value investing, you should take a look at this book. If you want your children to understand the stock market and invest for their future, you can't go wrong with this.

S**Y

Simple and straight to the point. An essential part of anyone's library, let alone investors...

C**T

It's so give you a basic idea about how stock market with and how to find companies to invest and how long should you invest. You will not become a investment wizard after reading this, but it will give you a head start. You can't solely rely on this book, but this book will help to understand the advanced books you'll read later. I'm planning to read another book "InvestED".

H**N

A must read for any serious investor.

J**E

It’s a must read for all investors in general, especially new investors.

Trustpilot

1 month ago

2 months ago