Customer Services

Copyright © 2025 Desertcart Holdings Limited

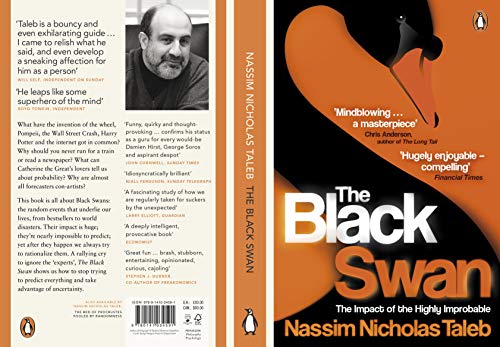

Buy The Black Swan: The Impact of the Highly Improbable 02 by Taleb, Nassim Nicholas (ISBN: 9780141034591) from desertcart's Book Store. Everyday low prices and free delivery on eligible orders. Review: Amazing, but will not appeal to eveyone - This is an amazing, nuanced book dealing with psychology, social science and meta-knowledge, as much probability. It is a worthy successor to his earlier work `Fooled by Randomness', and a book that can (and ideally should to get the most out of it) be read multiple times. The book will not appeal to everyone especially those whom are attacked within (largely experts in business, probability and mathematics). The book does not contain any specific information about how to get rich or increase ones wealth (though the ideas can be applied with some thought). It will appeal most to those interested in philosophy, epistemology and how we use knowledge. What I loved about this book I love books about ideas. The positive outlook the book has (about positive black swans as much as disasters). That is was even better reading it for the second time. It treats the reader with respect and does hold you with kid-gloves as some other social science books do. Though pointing out what appears obvious at first the way that each idea is dealt with sheds new light and is a real eye opener. That the ideas are more nuanced than they first appear. That there are many jumping off points for other ideas and books to read. That there is much of the author contained within and it is in part autobiographical. Some of the issues with the book: Some of the examples and metaphors could have been better explained or clearer. The ideas needed to fully appreciate the ideas within are contained within the book itself. It is only on second or third reading that the ideas become clearer. Depending on how you view this it is either a positive or a negative (personally I felt that this was a great positive). A reader can be highly prone to `the confirmation bias'. Leading to the likelihood that: either the reader will think that this is all obvious and the book is largely pointless; or that the author is full of it and the book is largely pointless. If you can see that the points that you are as likely to be fooled as anyone else the book becomes a lot clearer. The book is far from perfect, however it is an amazing read and this is why I give it 5 out of 5. Review: An excellent book somewhat spoiled by the tone of the author - I must admit that I approached reading this book with some trepidation. I had read Taleb's earlier book "Fooled By Randomness" and whilst I found that book very interesting I also found it very exasperating. This book was the same, only more so. The central theme of the book is that unexpected random events are much more likely to have far greater impact than is presumed by traditional statistics . In contrast he shows that there are domains where extreme events or values are more frequent and dominate overall. Taleb's arguments are convincing and he also shows why prediction in general is very difficult and describes human being's desires to post-rationalise events. Because prediction is thus impossible and because the impact of these extreme random events (the 'Black Swans') is so large his argument is that this makes a mockery of much of history, economics and financial theory. The main problem with the book is the tone of the author. Taleb clearly does not suffer fools gladly and it seems that he considers most people in economics, finance, statistics and academia as fools. He comes across as believing that he is the only one who really gets these ideas. His constant attacks on the 'dark suits' and academics (not to mention several strange jibes at the French) become very wearing. Also his dismissal of the normal distribution is overdone since there are clearly areas where it works well. All in all a very good book but I wish he would overcome his arrogance before the next one.

| Best Sellers Rank | 7,343 in Books ( See Top 100 in Books ) 1 in Financial Risk Management 190 in Philosophy (Books) 371 in Scientific, Technical & Medical |

| Book 2 of 5 | Incerto |

| Customer reviews | 4.3 4.3 out of 5 stars (7,824) |

| Dimensions | 3.05 x 12.7 x 19.56 cm |

| Edition | 2nd |

| ISBN-10 | 0141034599 |

| ISBN-13 | 978-0141034591 |

| Item weight | 349 g |

| Language | English |

| Print length | 394 pages |

| Publication date | 28 Feb. 2010 |

| Publisher | Penguin |

A**R

Amazing, but will not appeal to eveyone

This is an amazing, nuanced book dealing with psychology, social science and meta-knowledge, as much probability. It is a worthy successor to his earlier work `Fooled by Randomness', and a book that can (and ideally should to get the most out of it) be read multiple times. The book will not appeal to everyone especially those whom are attacked within (largely experts in business, probability and mathematics). The book does not contain any specific information about how to get rich or increase ones wealth (though the ideas can be applied with some thought). It will appeal most to those interested in philosophy, epistemology and how we use knowledge. What I loved about this book I love books about ideas. The positive outlook the book has (about positive black swans as much as disasters). That is was even better reading it for the second time. It treats the reader with respect and does hold you with kid-gloves as some other social science books do. Though pointing out what appears obvious at first the way that each idea is dealt with sheds new light and is a real eye opener. That the ideas are more nuanced than they first appear. That there are many jumping off points for other ideas and books to read. That there is much of the author contained within and it is in part autobiographical. Some of the issues with the book: Some of the examples and metaphors could have been better explained or clearer. The ideas needed to fully appreciate the ideas within are contained within the book itself. It is only on second or third reading that the ideas become clearer. Depending on how you view this it is either a positive or a negative (personally I felt that this was a great positive). A reader can be highly prone to `the confirmation bias'. Leading to the likelihood that: either the reader will think that this is all obvious and the book is largely pointless; or that the author is full of it and the book is largely pointless. If you can see that the points that you are as likely to be fooled as anyone else the book becomes a lot clearer. The book is far from perfect, however it is an amazing read and this is why I give it 5 out of 5.

D**N

An excellent book somewhat spoiled by the tone of the author

I must admit that I approached reading this book with some trepidation. I had read Taleb's earlier book "Fooled By Randomness" and whilst I found that book very interesting I also found it very exasperating. This book was the same, only more so. The central theme of the book is that unexpected random events are much more likely to have far greater impact than is presumed by traditional statistics . In contrast he shows that there are domains where extreme events or values are more frequent and dominate overall. Taleb's arguments are convincing and he also shows why prediction in general is very difficult and describes human being's desires to post-rationalise events. Because prediction is thus impossible and because the impact of these extreme random events (the 'Black Swans') is so large his argument is that this makes a mockery of much of history, economics and financial theory. The main problem with the book is the tone of the author. Taleb clearly does not suffer fools gladly and it seems that he considers most people in economics, finance, statistics and academia as fools. He comes across as believing that he is the only one who really gets these ideas. His constant attacks on the 'dark suits' and academics (not to mention several strange jibes at the French) become very wearing. Also his dismissal of the normal distribution is overdone since there are clearly areas where it works well. All in all a very good book but I wish he would overcome his arrogance before the next one.

W**O

Why do we demand simple explanations for complex phenomena?

I have always loved books that have been written to drive a major point through. "The Black Swan" by Nassim Nicholas Taleb definitely is one of those books. It clearly has a clear mission of its own. The reading of this book was, in fact, one of the most remarkable events in my life in the past few years. Nassim Nicholas Taleb has not written this book from a very personal viewpoint just to make himself seem important, which of course is always a motive in writing any book. However, he has done it because he has to make his readers understand how the message in the book is based on deep personal learning and a grander vision over the state of things. A previously little known person who does bring revolutionary new ideas to the grand international market of ideas just must first convince his readers of his or her worthiness as a thinker. His main message is to make his readers to understand the true unpredictability of the complex systems that so pervade the modern world. In my eyes his other big issue is to bring to light the fallacies that have twisted the field of modern economics. The real universal lesson that was hidden in this book was, for me at least, realizing that there are and even need not be simple and neat explanations for everything. There really are issues that cannot be easily explained at all. All possible explanations for them are just shots in the dark. This is true even if we tend to choose the most authoritative soundings ones and even treat them as some kind of `truth'. After reading this book, I also realized how philosophy allows us to explore also those important areas of life that do not have any kind of definite or final explanations. After all, this blog is largely about presenting new ideas on things about which we will never have any kind of final knowledge. For example, we can never really know what motivated the writers of the Bible in their work. We can only speculate. "The Blaxk Swan" was also extremely important because thanks to it I realized that we simply must endure a certain level of uncertainty if we even try to find any kind of answers to many questions. Sometimes demanding certainty would preclude even the posing of those questions. This book is about black swans or large, unpredictable events that do change and mold our world to a degree that is difficult to fathom at first. Nassim Nicholas Taleb comes from Lebanon. He really has first-hand experience of a black swan of monstrous proportions. This was the civil war of Lebanon that started in the year 1975. It did quite unexpectedly and utterly destroy the society that was deemed as even the most stable and dynamic in the whole of the Middle East. When our societies have become more and more complex, there are more and more things that cannot be explained with a simple cause and effect -chain, Hundreds or thousands of simultaneous processes do affect the outcomes of large systems like complex modern societies. As Nassim Nicholas Taleb says `we are explanation-seeking animals' and we want our neat `because'-answers preferably before bed-time, even if it is often impossible really to have one. Nassim Nicholas Taleb operates in the book mainly in the field of economics, where the tendency to create simplistic models to explain complex phenomena is possibly the greatest of all of the fields of human enterprise. He attacks modern economics vehemently and without mercy page after page. He is after something very real. I have myself for a long time thought that most modern economics is just emperors without cloths. I have reached this conclusion after following for 20 years economics as a professional journalist concentrating on economics. In my mind, highly complex and authoritative looking systems are built to hide the fact that economical models do not explain or predict anything of real importance. So, it is always a pleasure to find a world-class thinker and writer who thinks . In the real world the big swings in markets are those which really make or brake whole economies. However, modern economics cannot predict them or even explain them. Anybody can predict the steady movements on cool markets just by looking at the charts equipped just with a sharp pen and a suit. Nassim Nicholas Taleb speaks about `empty suits' and in the field of economic theory, where they are perhaps more prevalent than in any other field of human endeavor. In the fine-looking equations of the economists there almost invariably are missing the "g"and "f" -factors. They are the amount of purely emotionally explainable "greed" and "fear" in the market. However, these to things will often largely decide the really big moves on the stock markets. However, if one misses this, all the rest of equations are worthless. This is true, even if they can predict with great mathematical accuracy the workings of rational beings acting in a rational way. Unfortunately humans acting in stock markets are not such rational beings at all. They are driven largely by herd instinct and emotions. The real role of emotions and psychology in general in economic decision making process have been all too often been bypassed in economics. However, emotions are extremely important in even this field of live, besides their very central role in helping us cope with other people from day to day and most of all to cope with all the ever-chancing and stressful situations we encounter in life. Emotions are an extremely important product of evolution and evolution does not as a general rule produce things that are unnecessary, even if some older things can become redundant with time. In economics, the role of emotions as a major motivator for decisions is all too often still bypassed. This happens perhaps because changes in emotions are extremely difficult to predict. However, many economists stubbornly love to pretend that they really can predict things. The other extremely important feature that is in my mind one of the main forces affecting economy is of course the herd instinct. A human herd does need to have any kind of physical contact. Herds were formed with the use of rumors only even before the advent of modern media. However, herds are now formed (and also dispersed) in a blink of an eyelid thanks to the new information technology. Nowhere else this forming of virtual herds is so instantaneous as in the stock markets. The preceding passages are strictly my own thinking. However, Nassim Nicholas Taleb stops his critique short of this level. Just perhaps this is because he is himself part of the economic establishment that does feed on the gullibility of the investors. However, this group is a new incarnation of medieval Catholic clergy which did lead pleasure-laden lives that was paid for by the gullible masses. They were duped into believing that paying for the upkeep of this unproductive part of the population would be paid back for them in the after-world. Now the gullible masses are of course promised happiness right here on earth, if they just give their money for these wheeler's and dealers to multiply. Nassim Nicholas Taleb has brought the ire of the system on himself by revealing some of the most gaping holes in the system. However, he has stopped short of really analyzing the real, deep structure of the stock markets. In the stock markets of the world the few big fish feed on the herds of small fry. The little investors are lured into this giant Ponzi-scheme during a longer rise in the markets. This Ponzi-scheme is fed by the enormous dividends that are achievable during the rising markets. All too often the little men end up paying for the crashes, when the big fish swim away scratch-free. This book was still one of the most refreshing and thought-provoking reading-experiences I have had in a long, long time. "The Black Swan" is one of those books that I would like everybody to read. Reading it will inevitably broaden your horizons, even if you do not agree with all of the ideas presented in the book.

A**E

Not an easy read but worth your time. Must read for anyone working in the fields of economy/business. Eye opening. As per usual with Taleb, it’s packed with information and academic back but that’s doesn’t mean I did not laughed out loud from time to time. Great scientist, great author!

S**N

Book came on time and in perfect condition. Great seller and highly recommend!

A**R

Good read. Makes us think about alternatives and chances.

T**Y

good book

E**L

I am an Economist , needless to say i felt attacked a bit reading the book (if you read it you will get it), however you see that the point he is trying to make is very very powerful, so managing that he goes overboard and exaggerate on some things (various actually) will make you understand him more and understand his point of the power of the unknown which do seems to be forgotten about as if everything was predictable and expected, his style of writing is interesting, funny (sometimes) and clever, would recommend is an excellent book from NNT, its like opening a cookie jar who has an excellent cookie but slaps you a bit before you get it.

Trustpilot

1 month ago

1 day ago